Facts & Challenges

According to the Hans Böckler Foundation, the beverage industry is the third largest sector of the food and luxury food industry, accounting for around eight percent of sales. At its core, it comprises around 800 breweries (with more than 1,400 brewing sites) and more than 300 producers of non-alcoholic soft drinks and waters. The specialised wholesale beverage trade acts as a distributor of beverages to the retail trade (food retail trade and gastronomy). The beverage market in Germany is a very heterogeneous market and is divided into many local and regional sub-markets. The retail trade is the predominant sales channel for beverages. For example, the retail share of beer sales has risen to around 80 percent in recent years. The Bundesverband des Deutschen Getränkefachgroßhandels e. V. (Federal Association of German Beverage Wholesalers) counted 3,563 specialised beverage wholesalers with an annual turnover of almost 22 billion euros in 2017. Ideally, consumers return deposit bottles to their retailer who returns them to the manufacturer. There the bottles are checked, cleaned and refilled. It can be noticed that the number of disposable PET bottles used for soft drinks is constantly increasing.

Increasing automation and Industry 4.0 do not stop at the beverage industry. In addition, beverage consumption has been changing for some years now. While beer consumption has been declining for years (currently approx. 106 litres per capita and year), water consumption has recently increased significantly (approx. 149 litres per capita and year). The beverage market is under great pressure to reduce costs and prices due to changing consumer behaviour and the strong position of food retailers (discounters). The beer market as well as the non-alcoholic beverage market is divided into many local and regional sub-markets. Extensive consolidation is not expected in the coming years, which could lead to a sharp decline in the number of competitors. The other development that has been observed in recent years is that beverage producers were bought out by the food retail trade. The Schwarz Group (Lidl, Kaufland), which took over the mineral water company MEG in 2008, is a classic example of this development. Selling beverages online could also be a growing sales channel for discounters in the future. However, the range of products offered online is usually limited and deliveries are often made in large cities and metropolitan areas only since logistics costs are high. Strong seasonal fluctuations in sales figures are characteristic of the beverage industry.

Trends in the wholesale beverage sector

- Ongoing demographic and socio-cultural developments are accelerating, leading to further changes in beverage consumption Consumption of beer and juices is dropping Saturation is taking place on the soft drink market The demand for mineral waters keeps growing

- Continuous reduction in the number of beverage producers (growth through consolidation) Overall export growth rates are too low to compensate for declining domestic consumption in the long term

- Food retailers / discounters continue to have a strong influence on pricing due to their enormous market power

- Deposit-return systems are coming under increasing pressure due to the advance of ecologically unfriendly single-use bottles

- New distribution channels for beverages (online trade, virtual retail shelves)

- Implementation of Industry 4.0, digitization is progressing

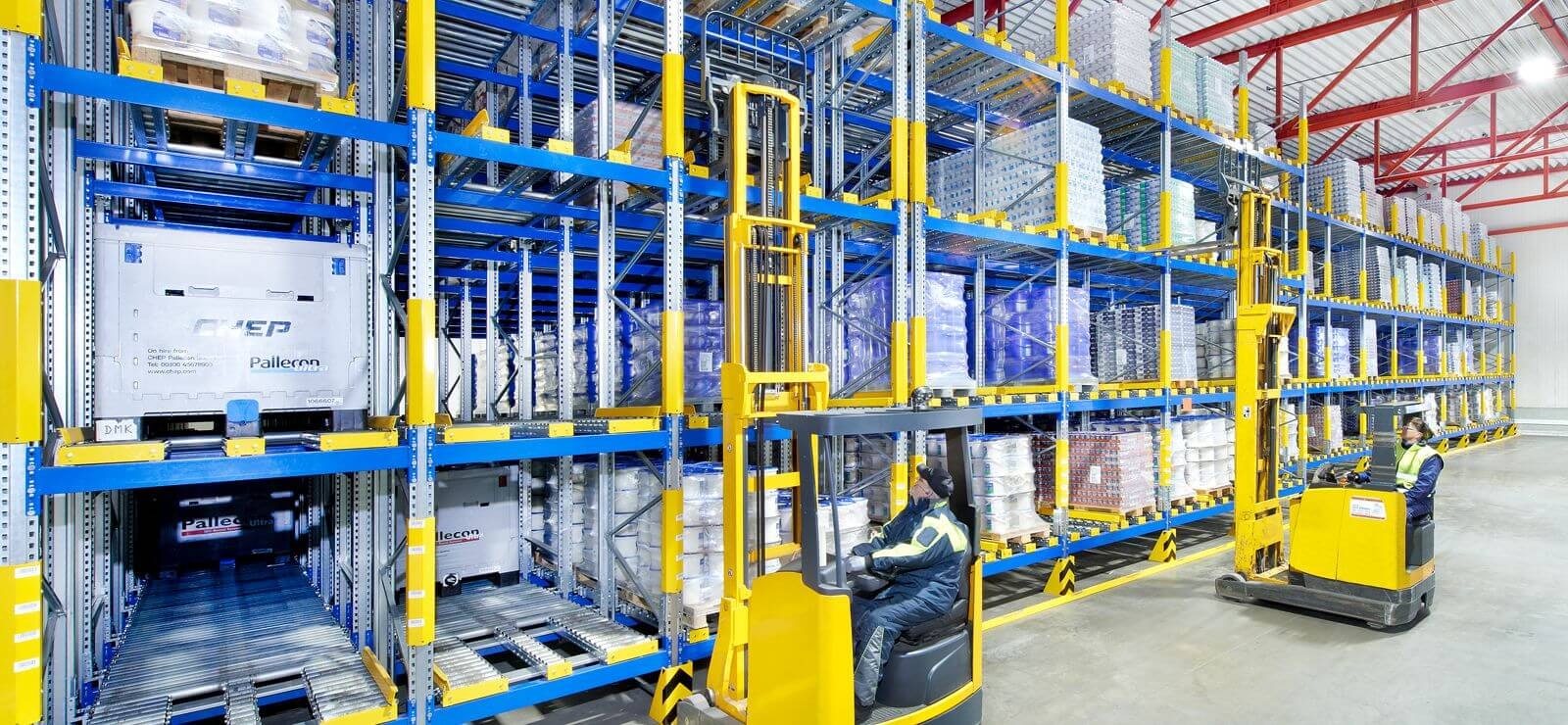

- Great potential for optimisation through automation and new warehouse technologies

Requirements

Beverage logistics is characterised by strong fluctuations. Sales quantities can vary up to 40 percent depending on the season. Demand is significantly higher in summer. In addition, supplies must be refilled quickly - very short response times of 24 to 36 hours are common in this industry. This requires very flexible and efficient material handling and storage. In most cases, work schedules are planned on the basis of available forklift trucks and order pickers, previous year's figures, holidays and weekends, as well as the weather forecast, and order peaks are smoothed out in advance. Success depends on the seamless linkage between the various actors of the supply chain. Especially in beverage logistics there is an enormous potential for optimisation. Beverage warehouses can be automated, for example, more efficient warehouse management and control systems can be implemented. To improve productivity, separate picking areas or warehouses can be set up and enhanced f. ex. by pick-by-voice technology, or order collation stations can be introduced. Beverage pallets are often block stacked on the warehouse floor. This storage method needs a lot of space. However, with pallet flow racks it is not only possible to significantly increase the number of pallet positions and throughput speed, but also to separate goods coming in from goods going out. That’s how it works: Beverage crates stored on European size pallets are delivered by freight vehicles to the goods-in department. The crates are then unloaded by forklift trucks and fed short side on into the racking lanes at the loading side of a pallet flow rack. The lanes are mounted with a slight slope downward from the goods receiving side to the picking area. Moved by gravity, the pallets travel down the lane on conveyor rollers which have been set at a fixed gradient. This storage method enables compact storage in lanes and provides a sufficient buffer for balancing demand levels. Pallet speed is controlled with the help of brake rollers that ensure that the pallets do not run into each other. In general, pallet flow systems, also known as gravity flow or gravity-fed racks (GFR) accommodate bulk goods with a fast turnover such as mineral waters. Apart from storage in FIFO order, operators will benefit from a smooth and safe workflow. Incoming and outgoing merchandise is clearly separated and lift truck drivers do not get into each other’s way, because they are working at opposite sides of the racking.